Payments Testing: What is it? The 2025 Ultimate Guide

Today's online businesses are wrestling with 20+ forms of payment, from traditional e-transfer to cryptocurrency to afterpay programs. Globalization adds different currencies, languages, and privacy concerns not present in real-world transactions.

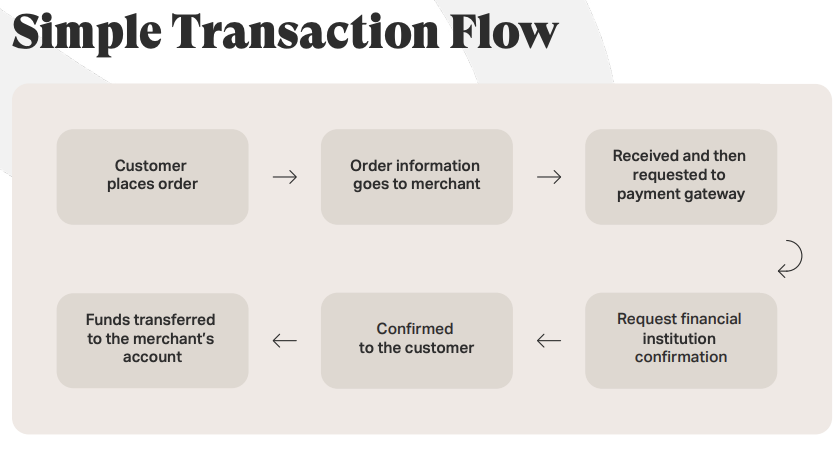

Payment testing follows the money from when the customer decides to pay to when the money arrives in a business account. The digital payment industry is expected to reach over $15 trillion by 2027, representing a doubling forecast from 2021.

Therefore, performance issues in the payment flow at any point in the process can cause you to lose a sale or even a customer – whether it is B2B, B2C, or any other model. Both e-commerce sites and game apps on phones need reliable payments. The methods may differ, but the goal is the same.

In this guide, we’ll cover everything you need to know about payment testing, including test strategies, use cases, and what to expect for results.

Table of Contents

- What is Payment Testing

- Payment Testing vs Payment Gateway Testing

- Types of Payment Testing

- Payment Testing on Real Devices

- The Rise of Digital Payment Methods

- How to Test Payment Functionality

- Payment Testing Use Cases

- Payment Testing Examples

- E-Commerce QA Testing

- Manual vs. Automated Payment Testing

- End-to-End Coverage

What is Payment Testing

Payment testing involves verifying the functionality, security, and usability of a payment system or application. The goal is to ensure that users can complete transactions smoothly and safely, while businesses can rely on the system’s compliance with industry regulations and standards.

Every step in the payment process must be checked individually (e.g., with unit testing) and as a whole (e.g., end-to-end testing). This can include testing the various components of the system, such as the payment gateway, payment processors, and methods, to ensure that they are working correctly and securely.

Failures anywhere in the process can stop the transaction, and your software must be able to recover and try again, or the sale will be lost.

Without thorough payment testing, problems range from trivial to catastrophic, like insecure API calls and malicious hacking attempts. If your QA process fails to detect an issue, both your finances and reputation are at risk.

Payment testing verifies that the payment system is reliable, secure, and compliant while providing an intuitive experience for users.

Payment Testing vs Payment Gateway Testing

Testing the payment flow is essential when building or maintaining any platform that involves transactions, from e-commerce sites to subscription services.

However, there’s often confusion between payment testing and payment gateway testing, even though both are critical in QA.

In simple terms, payment testing refers to validating the entire transaction experience from the user’s perspective, including what happens when they click “Pay,” how errors are handled, what confirmations they see, and how orders are logged.

Meanwhile, payment gateway testing focuses specifically on the technical integration between your system and a third-party service like Stripe, Razorpay, or PayPal, making sure the two systems talk correctly, securely, and reliably.

Let’s explore how they differ in terms of features:

| Feature | Payment Testing | Payment Gateway Testing |

| Scope | End-to-end user transaction flow | API and webhook communication with the gateway |

| Focus | User experience, UI feedback, business logic | Technical integration, API tokens, webhooks |

| Systems involved | Frontend, backend, order database, emails | Your backend ↔ third-party gateway |

| Real user flow tested? | Yes | Not necessarily (often simulated/mocked) |

| Tooling | Cypress, Selenium, manual UI tests | Postman, curl, gateway sandbox/dashboard |

| Common failures caught | Card errors, timeouts, retries, double charges | Token issues, 3D Secure failures, invalid webhooks |

| Test audience | QA engineers, product owners | Devs, backend engineers, integrators |

Real-World Examples

Payment Testing:

- A user selects a product, applies a discount code, enters valid card details, and receives a confirmation screen and email.

- A user submits expired card data and sees an error like “Card expired.”

- Double-clicking the “Pay” button doesn’t trigger duplicate charges.

- A user starts payment, then cancels — the app correctly restores cart state.

Payment Gateway Testing:

- You simulate a failed payment by sending an invalid API token to the Stripe sandbox.

- You test how your backend reacts when PayPal sends a webhook with a “Payment Failed” status.

- You validate the 3D Secure authentication redirect and ensure it brings the user back to your site correctly.

- You simulate a delay in response and check if your system marks the payment as “pending” instead of “failed.”

When and Why to Use Each Type of Testing

Use payment testing when you want to:

- Validate the user-facing checkout flow and all touchpoints like order history, emails, and billing.

- Test for edge cases like insufficient funds, expired cards, or retry flows.

- Ensure a smooth experience on both desktop and mobile devices.

Use payment gateway testing when:

- Ensuring secure and accurate data exchange through webhooks, headers, and encrypted requests.

- Integrating a new payment provider or switching APIs.

- Handling advanced features like 3D Secure, subscription billing, or saved card tokens.

Types of Payment Testing

Payment types can vary, depending on the software. Some software is released as a Minimum Viable Product (MVP) before additional iterative updates add more functionality. An MVP payment system might help with a smaller set of payment types, with others added later.

Specific types of payment testing include:

Functional testing

Functional testing validates that your payments software is executing as expected, ensuring a quality product. Functional QA testing services help you identify and prioritize web and mobile app issues before your users do. Explore functional testing here.

Usability testing

Successful usability testing takes time and expertise to plan, recruit participants, manage flows, analyze data, and turn the results into action. Testlio’s full-service moderated usability offering connects you with experienced researchers to manage the end-to-end usability study as well as a network of participants that match your target users. Delight your users and deliver data-driven innovation without the hassle. Explore usability testing here.

Security

Protecting and encrypting financial data and personally identifiable information (PII).

Integration Testing

This is the phase of software testing where software modules are combined, requiring group testing. Integration testing evaluates the compliance of software or apps with specific functional requirements. Integration tests segment components or modules and verify the functionality of each one individually and as part of the group.

Performance testing

Performance testing is a collection of manual and automated testing techniques to evaluate a software application’s speed, responsiveness, and stability when subjected to a particular load or volume of use. It helps to identify problems and bottlenecks before a release. Explore performance testing here.

Load testing

Testing with large numbers of simultaneous transactions to verify system capacity and reliability when under stress

UI testing

User interface testing (UI functionality, specifically. UI and UX testing is another 3,000-word guide) primarily seeks to validate the function of two types of user interactions: inputs and visual elements. Can your web app accurately read a mouse click? Does a user keyboard integrate into your app and perform as expected? Are buttons/links/submission forms functional?

Localization testing

Localization is the process of ensuring an application looks and feels right to the target user. Localization testing verifies an application’s functionality and usability in a specific region. It checks native UI, language, currency, date & time formatting to meet the standards of that country. It must use language correctly and align with cultural norms.

Payment Testing on Real Devices

Many test plans rely on simulated testing environments using isolated systems or device farms. Credit card payment testing scenarios cannot be tested as easily through these methods. It’s challenging to set up a simulated financial system, including banks and credit card companies, and have their behavior match the systems you will be working with. While supporting testing on real devices in various locations requires additional work, it returns more benefits than a potentially flawed or limited test environment.

Testing teams worldwide can assess usability through various languages, currencies, and location-dependent factors (taxes, shipping, etc.). Credit card payment testing with real cards allows for tracking payments from the card company to the final bank. The best way to know if your payment system works is to use it.

The Rise of Digital Payment Methods

While one of the most familiar payment methods remains the credit card, both in real-world situations and online, new payment methods continue to gain acceptance. Since the pandemic limited in-person contact, digital payments have become more popular than ever. To compete, e-commerce companies must support more of these methods. Digital payment types include:

- Online E-payment Systems: Bank transfers, e-checks, and wire transfers

- Mobile Payment Apps: Venmo, PayPal, and others

- Buy Now, Pay Later: Point-of-Sale financing

- Contactless Payment: NFC and MST technology for tab-enabled cards, smartphone digital wallets, or smartwatches

- Digital Wallets: Apple Pay, Google Pay, or others

- Cryptocurrencies: Bitcoin, Litecoin, Dogecoin, or others that are not tied to banks or national currencies

Today, the digital payments industry is expected to reach over $15 trillion by 2027, representing a doubling forecast from 2021.

How to Test Payment Functionality

Defining payment functionality is the first step any payment testing service should focus on. This step involves:

- Scope: Detailing what payment types are supported, in what currencies, and from what locations to allow a test engineer to set the scope of the testing necessary

- Use Cases and User Profiles: They create use cases and user profiles from there.

- Test Cases: The engineer then creates test cases detailing a step-by-step operation a tester will follow to test the function

- Runs: The tester records the results each time the test case is run, specifying if it passes or fails and documenting any defects found

- Data Analytics and Reports: As the tester gathers this information, analysis systems and reports use the data to report on the overall stability of the software

Payment Testing Use Cases

If a web or mobile app’s payment processing runs into issues, it can lead to severe financial headaches: Loss of funds, over or underpayments, penalties, and valuable time lost identifying and rectifying errors. Not to mention losing trust and reputation with customers and third-party businesses. These five payment processing use cases illustrate the complexity of ensuring functional financial transactions across many payment platforms.

- Credit Card Validation: Depending on the scope of support for credit cards, it can be necessary to validate different information depending on the location, currency, and banking system. When a user enters their information, various checks can be performed before processing to be sure it matches the expected formats.

- Connection Status: When initiating a payment, the software must connect to an external processing system and maintain that connection until completion without time-outs. In case of disconnection, messages must be sent to both the user and external system, with a simple method, to resume the transaction.

- Payment Confirmation: Once complete, the transaction must be confirmed and reported to the user. Additionally, the software for your company must record the payment confirmation.

- Verify Other Transaction Data: All other information supported by your systems, such as taxes, legal requirements, and platform billing standards, must be checked after completing the transaction.

Payment Testing Examples

Testing a payment system isn’t just about running a card through a form and hoping it works. It involves simulating real-world behaviours, edge cases, and high-risk scenarios that could impact trust, revenue, and compliance.

Below are examples that show how to apply key testing principles practically:

Test a Successful Card Transaction

A basic flow that should always work and fail gracefully if it doesn’t.

Scenario: A user completes a transaction using a valid credit card.

Steps:

- Add items to the cart and proceed to checkout.

- Choose a credit card as the payment method.

- Enter valid test card details (e.g., 4111 1111 1111 1111, expiry: future date, CVV: 123).

- Submit payment and observe the response.

What to Check:

- Does the success message appear?

- Is the transaction logged in the system and visible in the admin panel?

- Does the user receive a confirmation email?

- Are taxes, shipping, and discounts applied correctly?

Validate Failed Payment Attempts

Payment systems must block invalid inputs and explain why the failure happened.

Scenario: A user enters incorrect card details.

Steps:

- Enter a malformed or invalid card number (e.g., too short, invalid format).

- Submit the payment.

What to Check:

- Does the system reject the transaction?

- Is the error message clear (e.g., “Invalid card number”)?

- Is the user allowed to re-enter and retry?

- Is no order created or charged in the backend?

Test Payment Timeout or Slow Gateway Response

Some gateways may hang, timeout, or drop responses entirely. Your system needs to stay stable when that happens.

Scenario: Simulate a delayed or dropped response from the payment provider.

Steps:

- Use a mock or gateway testing tool to simulate a delayed response (e.g., 30+ seconds).

- Submit payment under this condition.

What to Check:

- Does the UI show a loading state or spinner?

- Does the system eventually mark the transaction as “pending” or “failed”?

- Is the order held or canceled properly?

Simulate 3D Secure Authentication (SCA)

If your gateway uses 3D Secure (OTP, biometric verification), you need to simulate that flow.

Scenario: A user pays with a card requiring 3DS authentication.

Steps:

- Use a test card number that triggers 3D Secure in sandbox mode.

- Submit payment and complete simulated authentication.

What to Check:

- Is the redirect to authentication handled properly?

- Does the system resume correctly after verification?

- Is the transaction marked “authenticated” in gateway logs?

Load Test High-Volume Transactions

Your system should hold up during peak usage, like flash sales or ticket launches.

Scenario: Hundreds of users check out at once.

Steps:

- Use tools like JMeter, k6, or Locust to simulate simultaneous payments.

- Include realistic cart data and variations in payment types.

What to Check:

- Are all payments processed within acceptable response times?

- Are there any bottlenecks in form validation, payment confirmation, or webhook processing?

- Do logs and dashboards reflect real-time transaction load?

Test Refunds and Reversals

Testing shouldn’t end after a transaction goes through. You also need to test what happens when it’s reversed.

Scenario: A customer requests a full or partial refund.

Steps:

- Locate a completed transaction.

- Initiate a refund through the admin panel or via the gateway API.

What to Check:

- Is the correct amount refunded?

- Is the transaction status updated on both systems (your backend + gateway)?

- Is the user notified about the refund?

Mobile Compatibility Check

Most users now pay from their phones, and the experience must be flawless.

Scenario: A user completes a payment from a mobile device.

Steps:

- Test the full flow on multiple devices (iPhone, Android, tablets).

- Try with native wallets (Apple Pay, Google Pay) where available.

What to Check:

- Are Touch ID/Face ID flows supported where applicable?

- Does the payment form render correctly?

- Are tap inputs, auto-focus, and validation working?

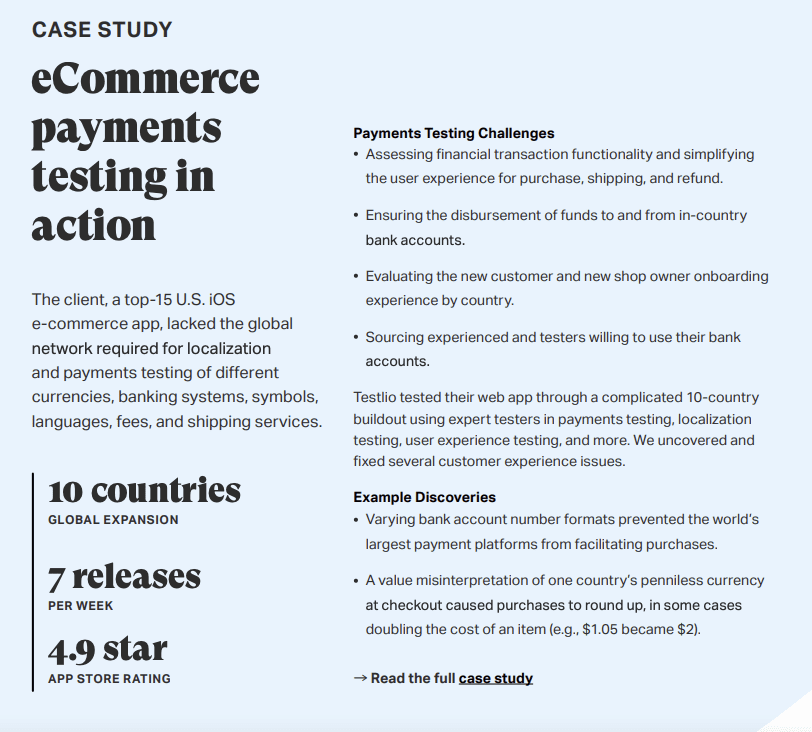

E-Commerce QA Testing

Most companies understand the relationship between secure payments and financial success. Still, some might not realize that public discovery of flaws (including fraud) can damage their reputation and, therefore, their profitability. A thorough pre-release testing strategy and ongoing testing after launch can prevent these defects from reaching production or finding them before bad actors do. The investment in post-launch testing pays off in preventing direct losses through fraud or theft and retaining customer trust and loyalty.

Read more about the case study here.

Manual vs. Automated Payment Testing

Every software testing project benefits from a mix of manual and automated testing. But payment testing presents additional complexities. Below is the comparison table between the two testing types:

| Aspect | Manual Payment Testing | Automated Payment Testing |

| Human Involvement | High – Testers manually execute payment transactions to verify functionality. | Low – Scripts and tools simulate payment transactions. |

| Flexibility | High – Allows for exploratory testing and adaptation to unexpected payment issues. | Moderate – Limited to predefined scripts and scenarios. |

| Time Consumption | High – Each payment test case must be executed individually. | Low – Multiple payment test cases can be run simultaneously. |

| Error-Prone | High – Human errors can occur, especially with repetitive payment tasks. | Low – Reduces human error by performing the same steps accurately every time. |

| Initial Cost | Low – Generally lower initial cost for manual testing setups. | High – Higher upfront cost for automation tools and setup. |

| Long-Term Cost | High – Higher long-term costs due to labor intensity in manual testing. | Low – Lower long-term costs due to automation. |

| Reproducibility | Low – Difficult to reproduce complex payment scenarios like time-outs or data corruption. | High – Easily reproduces complex payment scenarios with mock inputs. |

| Real-World Simulation | High – Uses real payment methods and paths appropriate to the tester’s location. | Moderate – Simulates a variety of user paths but may not cover all real-world payment cases. |

Creating time-outs or data corruption using manual methods can be far too difficult, while automating the process with mock inputs is much easier. While the standard logic of automating simple and repetitive tests still holds, creating automated tests where difficult-to-reproduce cases are tested will provide additional value.

On the other hand, manual testing of the user experience cannot be replaced with automation. Automated tests only compare the expected information, while manual testers can deliver a more subjective assessment of how smooth and friendly the process is. Another advantage of manual testing lies in using real payment methods worldwide. While developers create automated tests to simulate a variety of user paths, actual testers will use paths presented by the software that are appropriate to their location.

End-to-End Coverage

Ultimately, it’s your responsibility to deliver a superior final product to your customer/client. Once you’ve planned out the scope, recruited staff, and run initial tests, it’s time to take hold of the E2E process.

Delivering a world-class digital experience requires a consistently performant application across various end-user traffic patterns, network access locations, and device configurations. How will you maintain quality as you add new features, develop your product further, and expand your user base?

Ensure seamless digital transactions with Testlio’s comprehensive payment testing solutions. Contact a member of our team to learn more!