25+ Global Payment Statistics To Inform Your Testing Strategy

Payment testing is essential for businesses in today’s digital world. It ensures that every transaction is smooth and secure, giving customers a seamless experience. Companies can prevent issues disrupting transactions by testing payment and fraud detection systems.

A smooth payment process is crucial for businesses. Any glitch can lead to lost revenue, unhappy customers, and security risks. Surprisingly, 62% of consumers abandon their carts if they encounter problems during checkout. This highlights how important it is to have a reliable payment system. Neglecting payment testing can result in failed transactions, frustrated customers, and potential exposure to cyber threats.

Understanding global payment statistics and how they impact your testing strategy helps protect business operations, maintain customer trust, and ensure a secure, efficient payment process. Let’s explore these statistics.

Payment Failures and Their Impact

1. Payment failure rates average between 5% and 10% worldwide, varying by region and payment method.

These failure rates pose a significant challenge for businesses. Even a small percentage of failed payments can quickly escalate, hurting revenue and customer trust.

Businesses must ensure their payment systems are reliable and well-tested to reduce these failures and keep transactions running smoothly.

2. Payment failures cost businesses around $20.3 billion globally every year.

This staggering amount shows how much revenue businesses lose due to payment failures.

Every failed transaction represents missed income, making it crucial for companies to address payment issues head-on.

By minimizing these failures, businesses can protect their revenue and improve profitability.

3. 40% of consumers abandon their purchase when a payment fails, and 33% won’t try again.

This payment statistic reveals the direct impact payment failures have on customer behavior. When payments don’t go through, nearly half of shoppers leave, and many won’t return.

Businesses must ensure a seamless payment process to retain customers and prevent lost sales.

Payment Ecosystem Complexity

4. The typical global e-commerce platform now supports around 140 different payment methods.

This wide array of payment options highlights the complexity of modern e-commerce platforms.

Businesses must ensure their systems can smoothly handle a variety of payment methods to cater to diverse customer preferences.

This complexity makes thorough testing essential to avoid errors that could disrupt transactions and impact customer satisfaction.

5. Over 200 payment methods are used worldwide, adding another layer of complexity to the payment ecosystem.

With so many local payment methods in play, businesses operating internationally face significant challenges ensuring compatibility and security across all options.

The variety requires meticulous testing to ensure that all payment methods function correctly, regardless of the customer’s location. This helps avoid transaction issues and enhances the user experience.

Increasing Use of Digital Payments

6. The global digital payments market was valued at $7.36 trillion in 2021 and is expected to reach $15.19 trillion by 2027, growing at a CAGR of 12.4% from 2022 to 2027.

This payment statistic shows how much consumers and businesses rely on digital transactions. As the market doubles, secure and seamless payment systems become even more critical.

Payment testing ensures businesses can handle this expansion without encountering issues that could harm their reputation or revenue.

7. E-commerce sales worldwide are projected to hit $6.3 trillion by 2024, with over 80% of these transactions coming from digital payments.

Digital payments are the preferred method for most e-commerce transactions, which highlights their role in driving online sales.

As more customers shop online, businesses must ensure their payment systems are flawless. Effective payment testing helps prevent transaction failures, keeping customers happy and boosting sales.

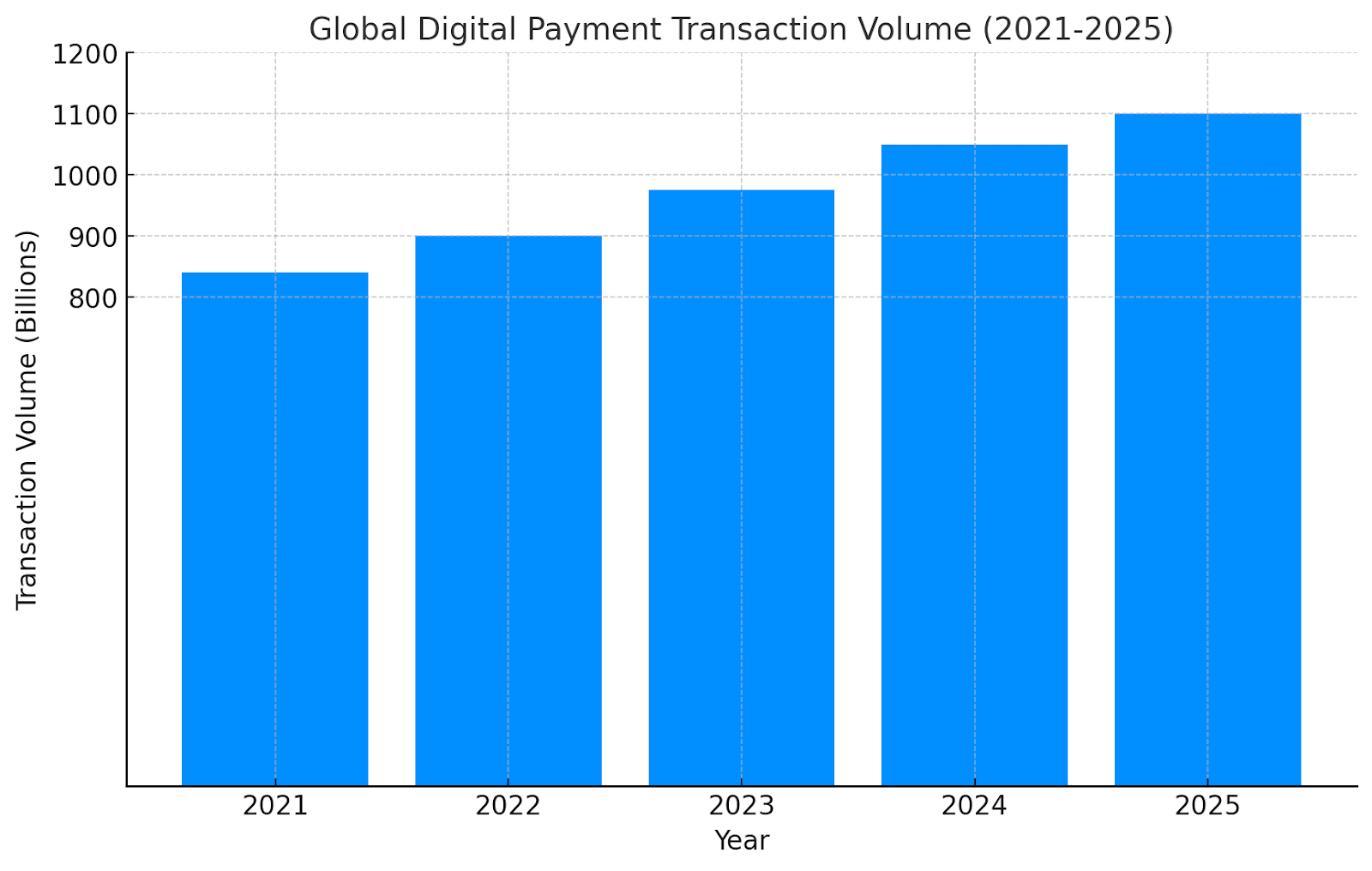

8. Digital payment transactions are expected to surpass 1.1 trillion by 2025, a jump from 841 billion in 2021.

This sharp rise in transactions shows how much the world leans on digital payments. As more people and businesses make online transactions, reliable payment systems become crucial.

By focusing on payment testing, companies can ensure their systems handle this growing volume without issues, keeping transactions smooth and secure and customers happy.

Mobile Payment Adoption

9. Mobile payment users are expected to reach 4.5 billion by 2025, a significant jump from 2.6 billion in 2020.

This rapid increase shows how quickly people turn to mobile payments as their preferred payment method.

As more users embrace mobile payments, businesses must ensure their systems are ready to handle the demand.

A smooth and secure mobile payment experience can help meet customer expectations and fuel business growth.

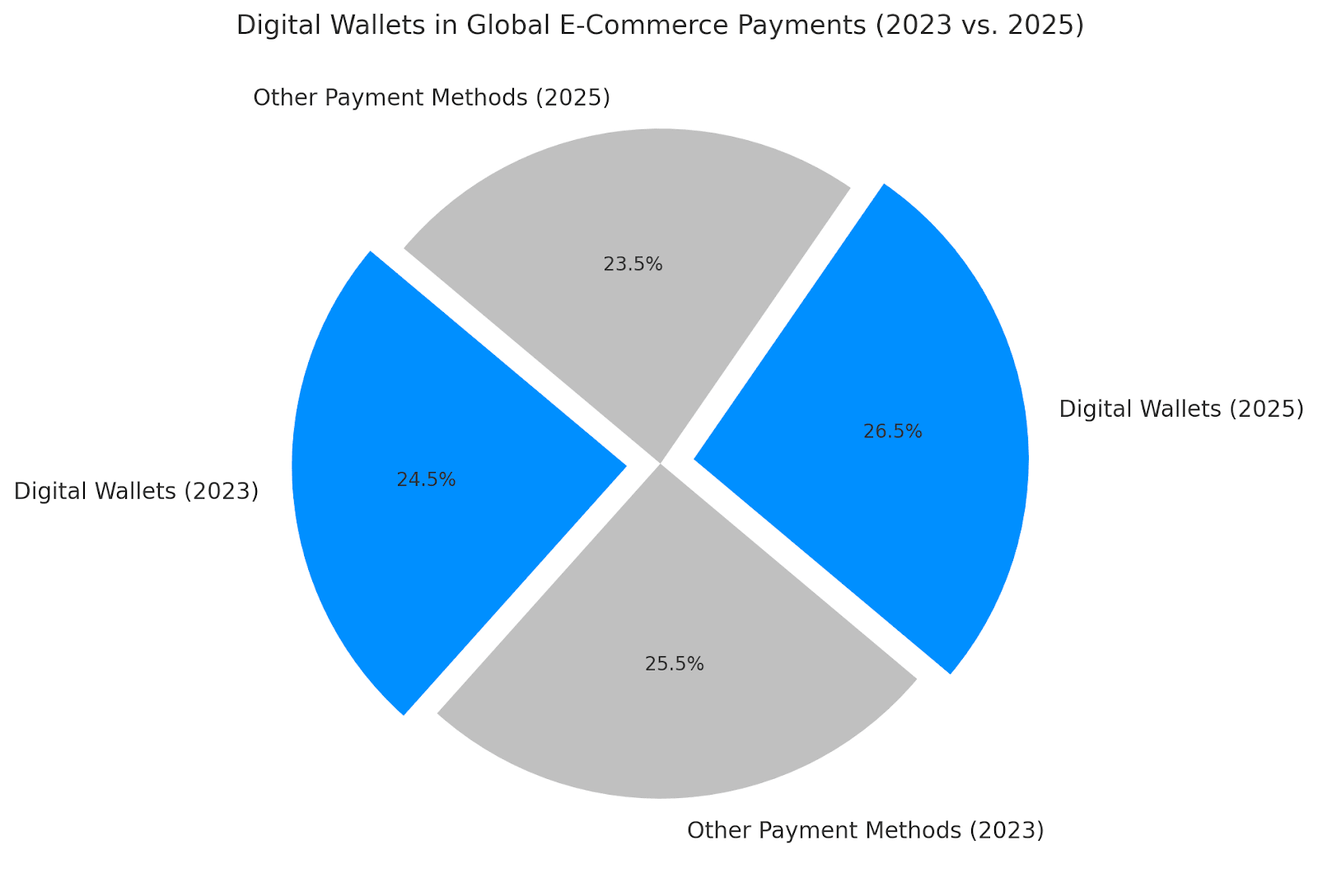

10. Digital wallets are set to account for 53% of global e-commerce payments by 2025, up from 49% in 2023.

The growing popularity of mobile wallets highlights their convenience and security.

With more shoppers choosing digital wallets for online purchases, businesses that integrate these payment methods can boost customer satisfaction and drive more sales.

11. Mobile payment adoption is growing over 30% annually in Africa and Southeast Asia, fueled by rising smartphone use and the spread of mobile money services.

This rapid growth in developing regions shows the power of mobile technology to bring financial services to more people.

As smartphone access expands, businesses in these regions must offer reliable mobile payment options to tap into this growing market.

Credit Cards and Bank Transactions

12. Credit and debit cards are used for 54% of global e-commerce transactions in 2023.

These payment statistics highlight that cards are still the preferred choice for most online shoppers. Despite the rise of newer payment methods, many people stick to what they know and trust.

For businesses, making card payments easy and secure is key to keeping customers satisfied and preventing abandoned carts.

13. In Europe, 25% of e-commerce payments are made through bank transfers, largely thanks to the SEPA system.

Bank transfers are popular in Europe because they offer a direct and secure payment method.

Offering a smooth bank transfer option is crucial for businesses selling in this market. It aligns with customer preferences and builds trust in the payment process.

Cryptocurrencies and Future Trends

14. Cryptocurrency payments are set to grow by 70% annually, with the market reaching $4.5 billion by 2026.

Cryptocurrency is quickly gaining traction as more people and businesses embrace it for transactions.

As this payment method grows, offering crypto options could set businesses apart, attract forward-thinking customers, and tap into a rapidly expanding market.

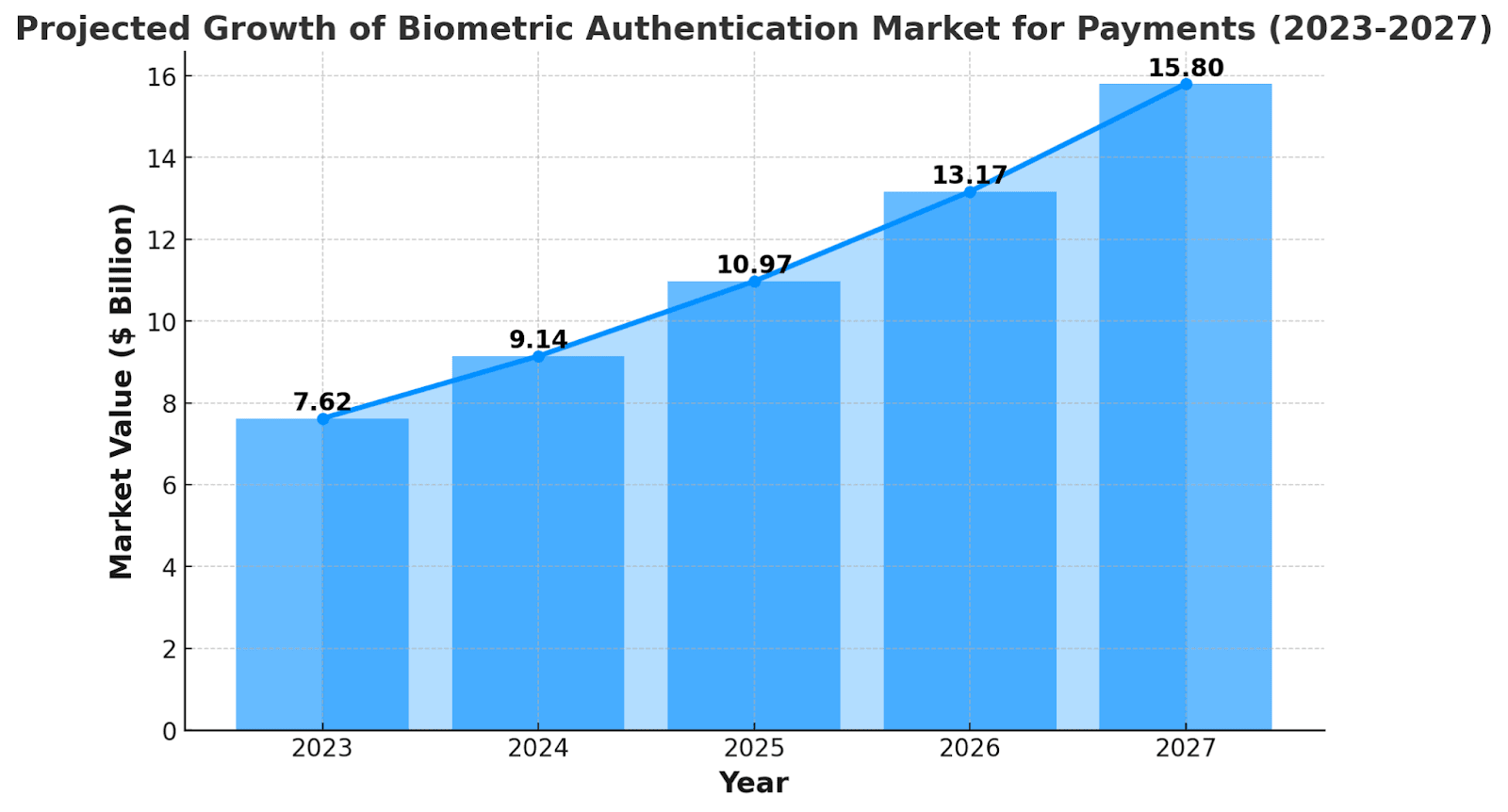

15. According to Juniper Research, the market for biometric authentication for payments is set to grow by 20% each year, reaching $15.8 billion by 2027.

This growth reflects how consumers increasingly trust biometric technology for secure and convenient transactions, making it an essential focus for businesses aiming to enhance payment security and user experience.

16. Allied Market Research reports that blockchain-based payments are projected to grow at a compound annual rate of 35%, reaching $8.7 billion by 2026.

This rapid expansion highlights blockchain’s significant impact on financial services. It offers a decentralized and transparent alternative that appeals to both consumers and businesses.

Cross-Border Payments

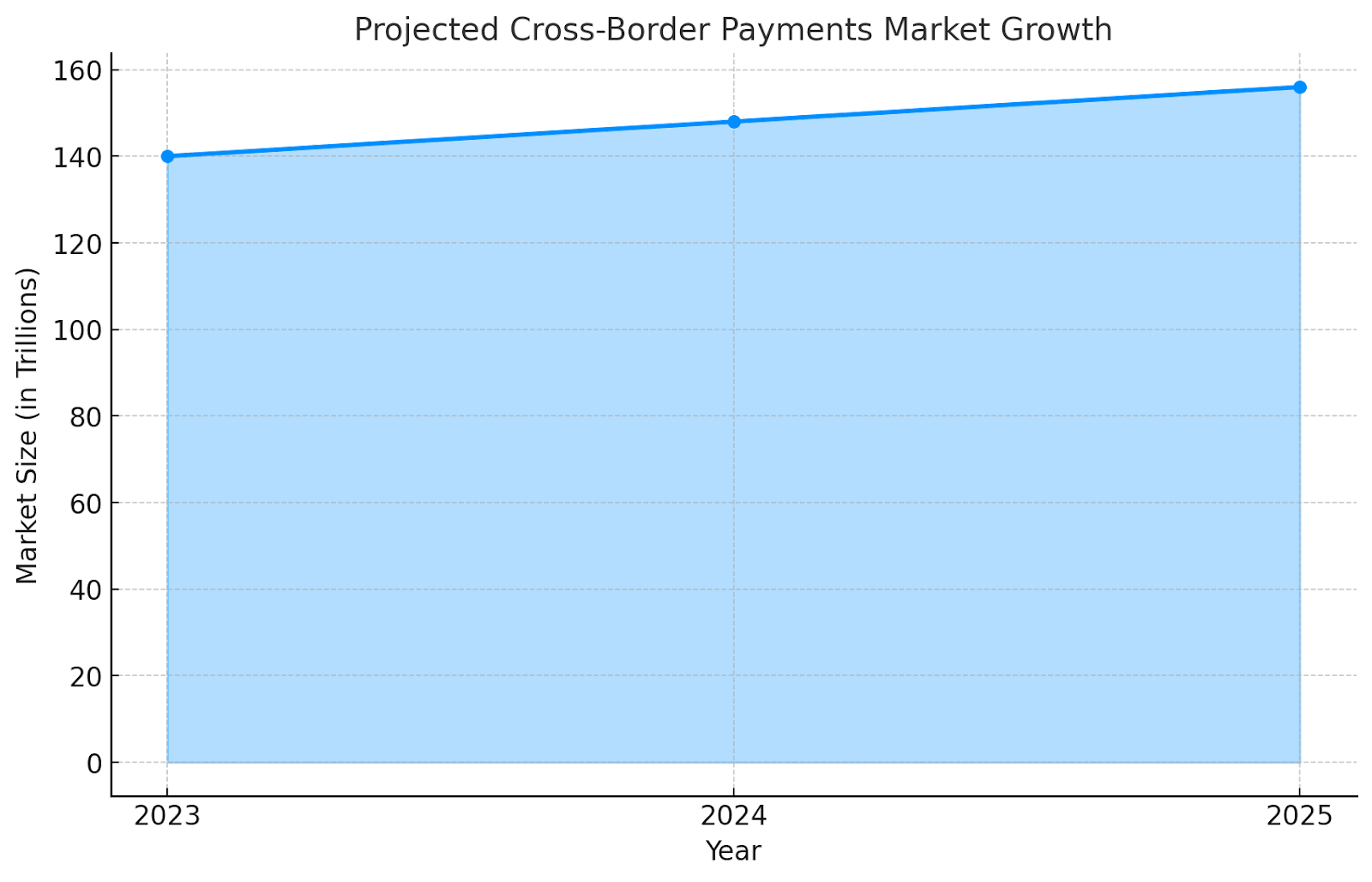

17. The cross-border payments market will likely reach $156 trillion by 2025, driven by the growth of e-commerce and global trade.

This enormous market size demonstrates the rapidly expanding global economy and the increasing need for seamless international transactions.

As businesses and consumers connect across borders, the demand for efficient payment solutions becomes even more critical, making this market a key focus for innovation and investment.

18. Around 15% of cross-border payments fail because of currency conversion issues or incompatible payment methods.

This high failure rate highlights the ongoing challenges in international transactions.

Solving these problems is essential to enhancing customer satisfaction, lowering transaction costs, and ensuring smoother operations in the increasingly interconnected global market.

The Role of Testing

19. According to Accenture, companies that invest in thorough payment testing reduce their fraud-related losses by 25%.

This reduction underscores the importance of proactive payment testing in protecting a company’s finances. By identifying and addressing vulnerabilities early, businesses safeguard their revenue and strengthen customer trust.

Automation and AI in Payments Testing

20. Automation boosts payment test coverage by up to 80%.

This increase in coverage is crucial because it thoroughly examines payment systems, catching potential issues that manual testing might miss.

By ensuring comprehensive testing, businesses enhance the reliability and security of their payment processes, which is essential for maintaining customer trust.

21. According to Testlio, automated testing reduces bugs by up to 40%.

This reduction is significant because it leads to smoother transactions and a better user experience.

With fewer errors in payment systems, businesses improve customer satisfaction and reduce the risk of financial losses and reputational damage.

22. Capgemini reports that AI and Machine Learning boost the accuracy of payment testing by 30%, particularly in detecting edge cases.

This boost is vital because identifying edge cases typically requires handling complex, unforeseen scenarios that traditional methods might miss.

By applying AI and Machine Learning, businesses can more effectively identify potential issues, ensuring more secure and reliable payment systems.

The Impact of Seamless Transactions

23. Optimized payment processes can boost conversion rates by 10-15%.

This increase shows how an improved checkout experience can drive sales directly.

By removing friction during payment, businesses convert more visitors into paying customers, making this optimization a critical factor in growing revenue.

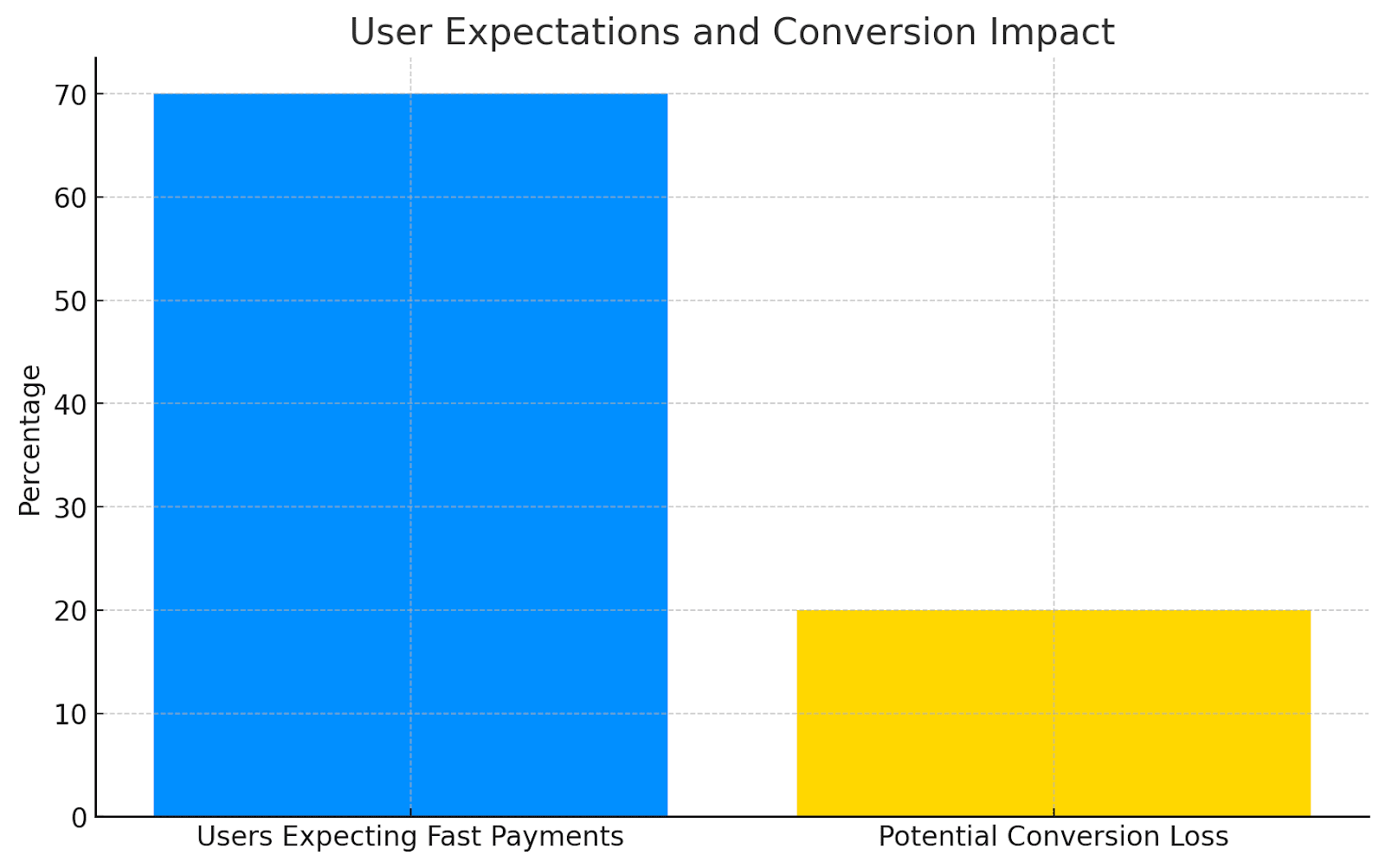

24. 70% of users expect payments to be processed in under 2 seconds, and delays can reduce conversions by up to 20%.

This payment statistic highlights the crucial role of speed in the checkout process.

Slow payment systems frustrate users, leading to cart abandonment. Therefore, investing in faster payment technologies is essential for retaining customers.

25. 80% of consumers prioritize a smooth payment process over other e-commerce features.

This insight shows that shoppers value ease of purchase above all else.

By focusing on user-friendly payment systems, businesses can significantly enhance customer satisfaction and build loyalty, giving them a competitive edge in the market.

26. Efficient payment systems increase customer retention rates by 15-20%.

This shows how crucial payment systems are in keeping customers satisfied.

By simplifying payment processes, businesses reduce friction, leading to higher customer satisfaction and stronger loyalty.

27. 62% of consumers will likely stay loyal to a brand when they experience smooth, hassle-free payments.

This emphasizes the importance of delivering a seamless payment experience. When customers enjoy a painless payment process, it builds trust in the brand, encouraging repeat purchases and long-term loyalty.

Final Thoughts

In the world of digital payments, ensuring the reliability and security of your payment systems is non-negotiable.

Payment testing statistics reveal the critical importance of thorough testing in preventing transaction failures, enhancing user experience, and safeguarding revenue.

A robust testing strategy is crucial, with the digital payments market set to double by 2027.

Testlio offers comprehensive testing solutions that can scale with your business across 600k devices, 800+ payment methods, and 150+ countries.

Contact a member of our team today to learn how you can unlock seamless global transactions and deliver seamless digital experiences.

Sources:

- Statista

- eMarketer

- Juniper Research (Mobile Payments)

- WorldPay (Global Payments Report)

- Allied Market Research (Cryptocurrency Market)

- McKinsey (Payments Ecosystem)

- Boston Consulting Group (Cross-Border Payments)

- McKinsey (Cross-Border Payments)

- PayPal (Digital Payments Future)

- Baymard Institute

- Juniper Research (Biometric Payments)