6 Tips for Stellar User Payment Testing Strategies

With millions of users and a 2023 evaluation of over $9 trillion, it’s time to dive into user payment testing with intent, strategy, and ferocity. These five best practices help identify and rectify common issues before causing severe problems in merchant systems.

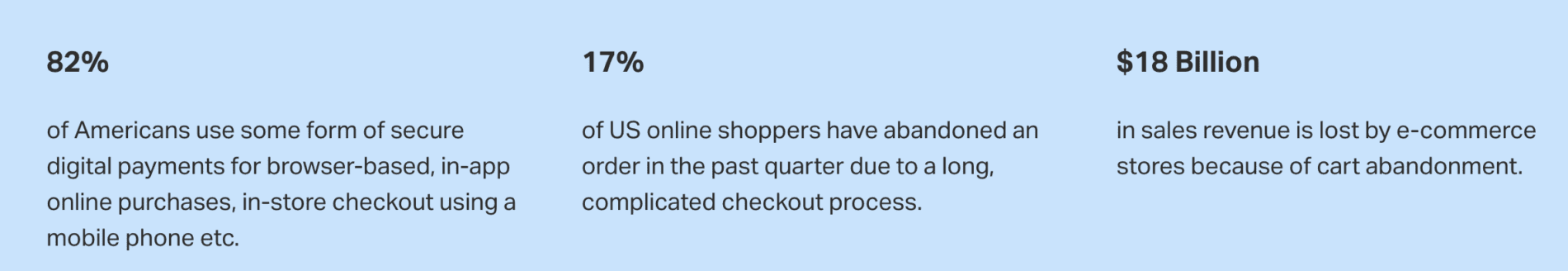

Errors in payment functionality have enormous potential to derail the relationship between consumer and vendor. Customers expect seamless, functional transactions without confusing messages or complicated steps. They expect security, privacy, and safeguards against over or underpayment. Any misstep in the payment process can lead to abandoned shopping carts, deleted apps, and consumer frustration.

Check Out Best Practices for User Payment Testing

Payment testing is guided by best practices that inform how the tests are designed, executed, and reported on to deliver dependable, robust testing. We also have a great guide to payment testing if you’re still learning on that topic.

1. Take an End-to-End Approach

End-to-end (E2E) testing verifies that all components of your payment flow work correctly in realistic scenarios. Using E2E methodology to test payment processes helps maintain quality in the development and expansion of your product.

An E2E approach ensures seamless integration of your payment gateway with your software ecosystem, internal workflow, and customer user journey. Using a comprehensive approach to test user payments allows you to identify potential issues early in the development process. This reduces the risk of errors that can cause your team and customers frustration and cost precious time and resources to fix. It allows you to anticipate and correct problem scenarios, making it easier to confirm compliance.

By eliminating potential problems from your payment process, an E2E approach optimizes the performance of your payment flow. This boosts customer confidence by delivering a smoother experience and preventing abandoned and failed transactions.

2. Combine Automated and Manual Testing

Software testing best practices across most industries indicate the efficacy of fusing manual and automated testing. Start by determining which test cases are best suited for automation and which need a human touch.

Automated testing can help create variables, like location identifiers, postage calculations, and currency conversion rates, to test use cases. Performing a functional test of a “pay now” button or a performance test to see how the server can handle multiple payments processing at once is perfect for automation as you can quickly execute tests at your current scale.

Beyond functionality, payment gateways must offer a great user experience. This, of course, is best tested by real people on real devices. Usability testing focuses on the experience of using the payment gateway to ensure it is easy to navigate. Using real devices to test location, O/S device compatibility, and network realities allows testers to match the diversity of actual users.

3. Execute Multiple Integration Test Cases

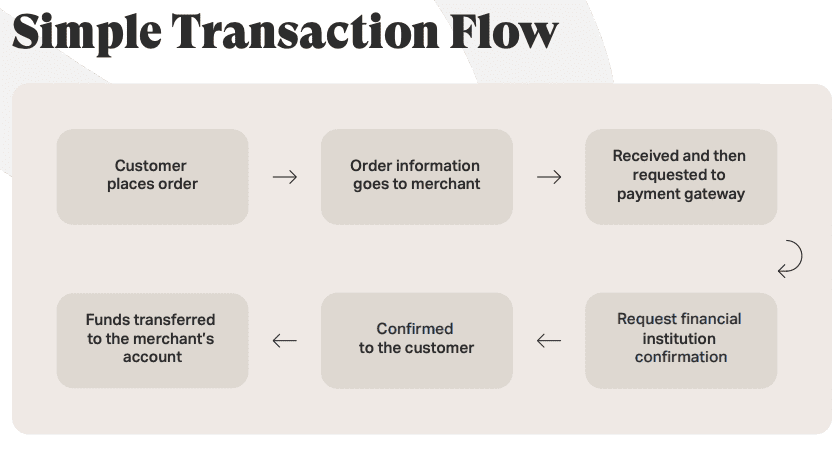

The source code must be bug-free, and connections between a merchant, financial institution, vendor, and device must be seamless every time. It’s crucial to run an integration test by adding each new online payment type. Adding Apple Pay, contactless pay, Klarna, Chime? Execute a new integration test. All new payment options must be independently tested and confirmed before accepting that payment method from a customer.

If your e-commerce website adds a new shipping option, country, or currency, another test must be added to ensure functionality.

When a top-15 U.S. iOS e-commerce company partnered with Testlio to deploy a testing team in 10 countries across four continents to conduct localized payments testing, they uncovered a giant bug. Testers discovered a value misinterpretation of their country’s penniless currency at checkout. A bug caused purchases without an even amount to round up, sometimes increasing the cost of an item (e.g., $1.05 became $2). The client used this information to develop a localized payment system and pricing model to prevent price round-ups.

Executing multiple location test cases can use region-based devices to verify that the payment gateway can handle customer locations and calculate the proper specifications (sales taxes, global shipping fees, conversion rates, import tax).

4. Test With Real Transactions and Payment Methods

For effective payments testing, it’s critical to test payments with real transactions and payment instruments, using real device testing. Many payment methods may be used in live transactions, including credit cards, debit cards, mobile payments, online payments, and offline payments. Testing all possible payment instruments with real transactions ensures that your payment flow is ready to process payments accurately in real-world scenarios.

Real transactions validate the functionality of your payment gateway and its integration with your payment processor. This helps confirm compliance with industry regulations and standards.

Testing with local currencies provides a more authentic user experience, helping identify barriers to customer satisfaction. It ensures accurate currency conversion and pricing for international transactions.

Real payment methods and currencies validate the adaptability of payment systems to diverse user profiles and use cases. This includes customers using different types of devices. While device clouds can simulate device diversity to a degree, they can’t duplicate important variables such as network latency, hardware configuration, localization nuances, localized security issues, and unforeseen user behavior. Real device testing using real transactions ensures that your payment process can meet the demands of real customers.

5. Use a Scalable Testing Platform

Utilizing a scalable testing platform can significantly expand the testing functionality and test cases as your business grows.

Platforms, a mix of software, testers, and services, should offer flexibility like testers leaping into action quickly to work in short bursts to augment your QA team during periods of peak demand. Testers then intentionally go dormant until the next run. As a result, capacity is available only when needed, and you don’t pay for idle personnel.

Testing for payment gateway performance will require developing scenarios and then running through each one to verify the payment gateway processes transactions correctly. Some test cycles may be larger than others (think performance testing for the maximum number of simultaneous transactions), and using a scalable platform will cater to specific run needs.

Having a platform that can adjust testing teams as needed helps you scale. Though you may begin with a few countries, five major financial institutions, and three currencies accepted on your e-commerce platform, you need a flexible platform to support extended testing to widen your user base or create an in-app payment processor.

6. Run a Pre-Test Pilot

Running a pre-test pilot is a handy safeguard before all of the data is loaded and scheduled to run.

Starting with a small run doesn’t risk significant delays or reruns if anything needs to be adjusted or added before the entire run. Adopting a pilot test approach allows the test parameters and design to be assessed (and even re-designed if necessary). For example, if there’s a significant source code issue in encryption, starting with a pilot run to eliminate and rectify issues will allow the second full-production run to find more minor bugs.

Running a pre-test pilot will establish suitable time frames for test team coordination. Your team should also manage task reports transparently while accumulating data to be filed in a final report.

Why is User Payment Testing Important?

Customers frequently abandon carts because of technical bugs, overcomplicated processes, excessive information requests, or in-app popups. User payment testing ensures that your customers enjoy a positive payment experience, boosting your customer retention and revenue.

During testing, prioritize user experience by considering the customer’s viewpoint and emphasizing communication and clear UX. If payment is successful, a payment confirmation should be provided to the customer to avoid cloned orders. Likewise, payment failure notifications should be provided, including helpful information to rectify the issue. Additionally, test for common triggers that can emotionally impact the end-user, such as time outs, discount code applications, button fails, and currency conversion issues.

Think user input is just a “suggestion”? Here are the hidden costs of skipping usability testing.

User-oriented payment testing will ensure that customers, merchants, and financial institutions operate through a platform with the highest functionality and usability parameters. In the best cases, testing payments tap into a global network of testers that can deploy industry expertise and burstable testing as new features are explored. Skilled testers take on the role of customers and merchants to perform a suite of tests that utilize powerful test management software to perfect the user experience from functionality to usability.