PaymenTs testing

Make every payment flow feel local, everywhere

Test across borders, payment types, languages, and devices. With global experts in your target markets, real transactions, and real payment methods, Testlio’s managed payment testing helps you validate every customer journey so your payments never fail where it matters most.

Your payment experience is the customer experience

When payments break, it’s not just a technical failure. It’s a lost customer, a missed opportunity, and a hit to your brand. Investing in payments testing as a core aspect of your customer service strategy helps:

Catch issues early

Identify retry failures, timeouts, and unsupported flows.

Prevent revenue leakage

Reduce failures, chargebacks, and refund disputes.

Protect brand reputation

Ensure payments work across markets and platforms.

Accelerate market launches

Test payment flows with local experts before you go live.

Support local preferences

Validate regional methods your users rely on.

Ensure multi-currency accuracy

Display correct pricing, fees, and conversions.

Verify regulatory compliance

Meet local rules for data and authentication.

Boost customer loyalty

Deliver trusted experiences that keep users coming back.

Real transactions. Real devices. Real payment methods.

With Testlio, you can get on-demand access to global experts who test your payment flow the way real users experience it. Capture regional nuances, local compliance requirements, and device-specific issues before they impact your launch.

800+

payment methods, including alternative payments and cryptocurrencies

600k+

devices including phones, tablets, smartwatches, and point-of-sale systems

150+

countries with in-market testers who speak over 100 languages

Types of payment testing use cases we cover

Payment Gateway Testing

Ensure correct processing of various transaction types (authorization, capture, sale, refund, void). Verify data security, service reliability, and consistency.

Payment Method Verification

Check the validity of credit card details and test new and alternative payment methods like mobile wallets across different devices, regions, and platforms.

Payment Processing Testing

Test payment flows end-to-end, from initiation to settlement, including POS and hardware functionality, software accuracy, and stress tests under peak load.

Payment Validation

Comprehensively validate transaction data and match it to account statements to ensure accurate details (amounts, dates, recipient information, etc.) and reconciliation.

Localized Payment Testing

Ensure regional compliance with local payment regulations, tax calculations, and user preferences. Verify accurate exchange rates and currency symbols across markets.

Cryptocurrency Testing

Confirm safe and reliable cryptocurrency handling by testing blockchain transactions, currency validation, and wallet integrations, including swap testing for exchanges.

Subscription Testing

Verify the functionality of recurring payment systems, including edge cases, to ensure accurate subscription processing, billing cycles, and timely notifications.

Onsite Testing

Test in specific physical locations with designated payment instruments to ensure reliable payment experiences in diverse scenarios and verify brand compliance.

Payment API Verification

Ensure reliable API integrations for inbound and outbound transactions by testing data accuracy, security, and performance, including pay-in and payout flows.

Powered by testers who understand payments

Testing payments isn’t just about executing test cases. It’s about understanding regional regulations, edge-case behaviors, and the integrations that power modern transactions. Testlio’s vetted experts bring deep knowledge of local markets and complex payment systems, helping you uncover the issues that create friction, drive abandonment, or erode trust.

Extensive coverage modern releases demand

Testlio validates every part of the payment journey, not just the transaction. We cover functional accuracy, localization, accessibility, AI-driven behavior, and device-specific differences. Whether you’re supporting new payment methods or launching in new markets, we test how your customers actually pay, across platforms, devices, and environments.

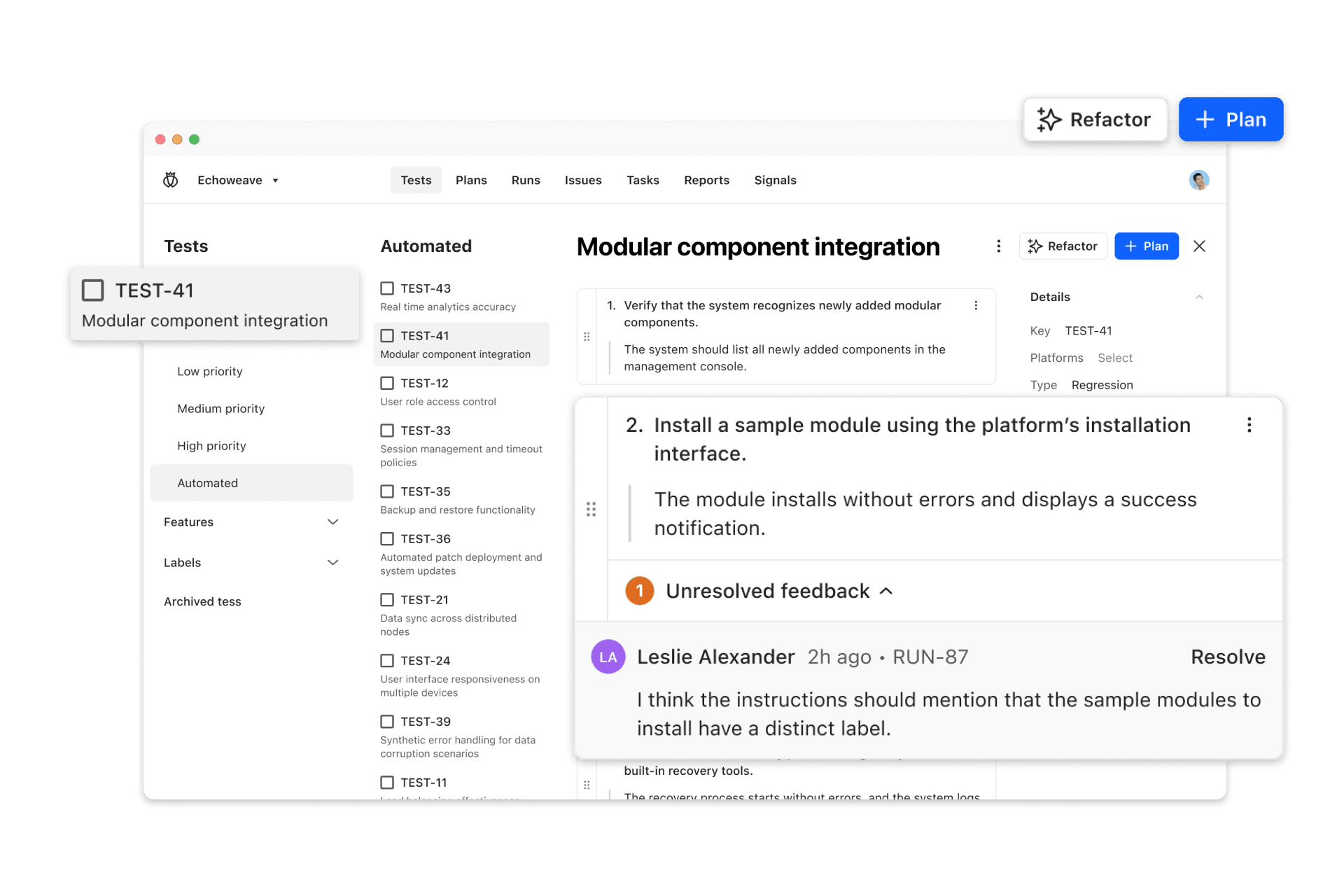

Made for teams who need visibility

Testlio’s platform helps you source the right testers with the certifications and skills to work on complex, sensitive payment flows. You get full visibility into who is testing, what was tested, where it failed, and why. With built-in AI, real-time reporting, and integrations into tools like Jira and TestRail, your team stays fast, informed, and in control.

Trusted by leaders across complex industries

From booking engines to banking apps, Testlio supports payment testing for global brands where performance, trust, and scale are non-negotiable.

Commerce & Retail

Test high-volume checkout flows, loyalty programs, regional payment methods, and promotions across browsers, apps, and point-of-sale devices.

Finance & Banking

Validate complex flows like wallet top-ups, peer-to-peer transfers, authentication protocols, and cross-border compliance in real regulatory environments.

Media & Entertainment

Verify subscriptions, renewals, and one-time purchases across platforms like mobile apps, smart TVs, and web. Catch failures before your users do.

Mobility & Travel

Validate multi-step booking flows, dynamic pricing, regional currencies, and in-location payments across mobile, web, and kiosks.

Software & Services

Ensure global payments work across subscription tiers, billing cycles, and tax jurisdictions for both individual users and enterprise clients.

Where real payments meet real expertise

Get the flexibility of crowdsourcing with the confidence of a solution built for complex payment flows. Testlio combines expert testers, real transactions, and end-to-end support to help you launch and scale with certainty.

End-to-end coverage

We handle everything from sourcing and vetting testers to executing payment scenarios and delivering insights your team can act on.

Deep domain expertise

Your dedicated client team brings payments expertise and strategic alignment to every test cycle so issues don’t slip through.

Scalable support

From new market rollouts to shifting payment providers, we adjust coverage and resources as your roadmap evolves.

Market-aligned testing

Test how your customers pay, with experts validating transactions in the regions, time zones, and channels that matter most.

Security at every step

We are ISO/IEC 27001:2022 certified and follow strict protocols to test safely, even with real payment methods and sensitive flows.

Case studies and resources

Advanced Payment Testing Strategies for Leaders

Transform your payment systems from points of failure into pillars of trust with strategies that deliver seamless, reliable transactions.

How YELL Builds Reliable Fintech Experiences

In this exclusive fireside chat, YELL and Testlio explore how great payment products are designed, built, tested, and released.

Leading Social Media Company Case Study

A leading social media and entertainment company leverages Testlio to navigate the complexities of global payment systems.

Optimize your payment flow at every step

Frequently Asked Questions

We combine vetted, in-market experts with real devices, real transactions, and actual payment methods. Testing is fully managed from scoping to reporting, so your team can focus on building while we validate performance, compliance, and user experience in the markets that matter most.

Yes. Our community validates experiences in 150+ countries and 100+ languages using the same devices, currencies, and payment methods your customers rely on. We test across 800+ payment options, including traditional cards, alternative methods, point-of-sale (POS) systems, digital wallets, buy now pay later (BNPL), cryptocurrencies, and more.

We are ISO/IEC 27001:2022 certified and operate under strict security protocols. All testers work under contracts, and testing can be conducted within secure, client-approved environments.

Timelines depend on the complexity of your flows, scope, and compliance needs. We involve our delivery team early to define goals, onboard testers, and align with your release schedule.

Pricing depends on testing type, complexity, and service level. There are no per-seat licenses. You pay for structured execution, vetted testers, platform access, and ongoing client services.

Yes. Our platform integrates with tools like Jira and TestRail so you can track issues, manage cycles, and review results without changing how your teams work today.

We choose testers based on market familiarity, payment system expertise, device coverage, and relevant certifications. This ensures realistic testing of both common and complex flows.

Yes. In addition to validating payment functionality, we test localization, accessibility, AI-driven elements, performance under various network conditions, and device-specific behavior.

Yes. We can validate against local and global regulations, authentication protocols, and privacy standards relevant to your target markets.

We use AI to streamline test case creation, detect coverage gaps, and refine reporting. AI speeds up execution and analysis but is always paired with expert human oversight to ensure accuracy and context.