End-to-end cross-border payments testing made easy

Failed or imperfect cross-border payments can damage your reputation and reduce revenue. With Testlio, you can conquer the challenges that local requirements and variations bring by testing across diverse payment methods, devices, and regions.

![]()

Real-life testing for cross-border payments on a global scale

Our cross-border payments testing leverages real devices, currency-specific payment methods, and country-specific requirements, reflecting regional differences and identifying device-specific issues that could impact international transactions.

Testlio’s cross-border payment testing coverage includes:

Real Transactions Across 800+ Payment Instruments

Test and validate real payment transactions in local currencies, covering specific regulations and tax implications.

Global Reach with Vetted Testers in Over 150 Countries

Access an international network of testers with localized knowledge of payment methods and compliance standards.

Distributed Real-Device Network with Access to 600K+ Devices

Test on real devices and payment instruments globally to cover any payment nuances by device and region.

Extensive Testing Across Traditional and Cryptocurrency Payments

Validate fiat and crypto transactions, including potential cross-border currency conversions and compliance challenges.

Types of payment testing use cases we cover

Cross-Border Payment Gateway Testing

Verify functionality, security, and reliability in various countries to ensure seamless transactions worldwide.

Localized Payment Method Verification

Validate regional credit card protocols, alternative payment methods, and currency accuracy in real time.

Cross-Border Processing Testing

Test physical and digital payment devices across borders to ensure compatibility with local systems.

Transaction Validation and Compliance Checks

Validate transaction data against local tax requirements, exchange rates, and regulations.

Cryptocurrency Testing for Cross-Border Transactions

Verify crypto payment flows, including swap testing, with specific attention to cross-border currency exchange scenarios.

Proven testing experience

We take ownership of your needs and act as an extension of your team. As your advisors, we ensure you receive the right guidance and resources to test any payment methods you require.

Extensive expertise

By leveraging our deep experience in payment testing, we help you incorporate a holistic strategy that utilizes various types of tests and approaches.

Vetted freelance network

Our testers are highly vetted and incentivized to test more thoughtfully. Only 3% of applicants to the Testlio Network are accepted to client projects.

Dynamic staffing

Our flexible staffing ensures that we continuously optimize your talent mix and capacity to increase productivity and meet your evolving requirements.

Actionable feedback

Our experts provide detailed notes on cross-border payment methods, currency conversions, and device usage to help you optimize payment flows and enhance the international user experience.

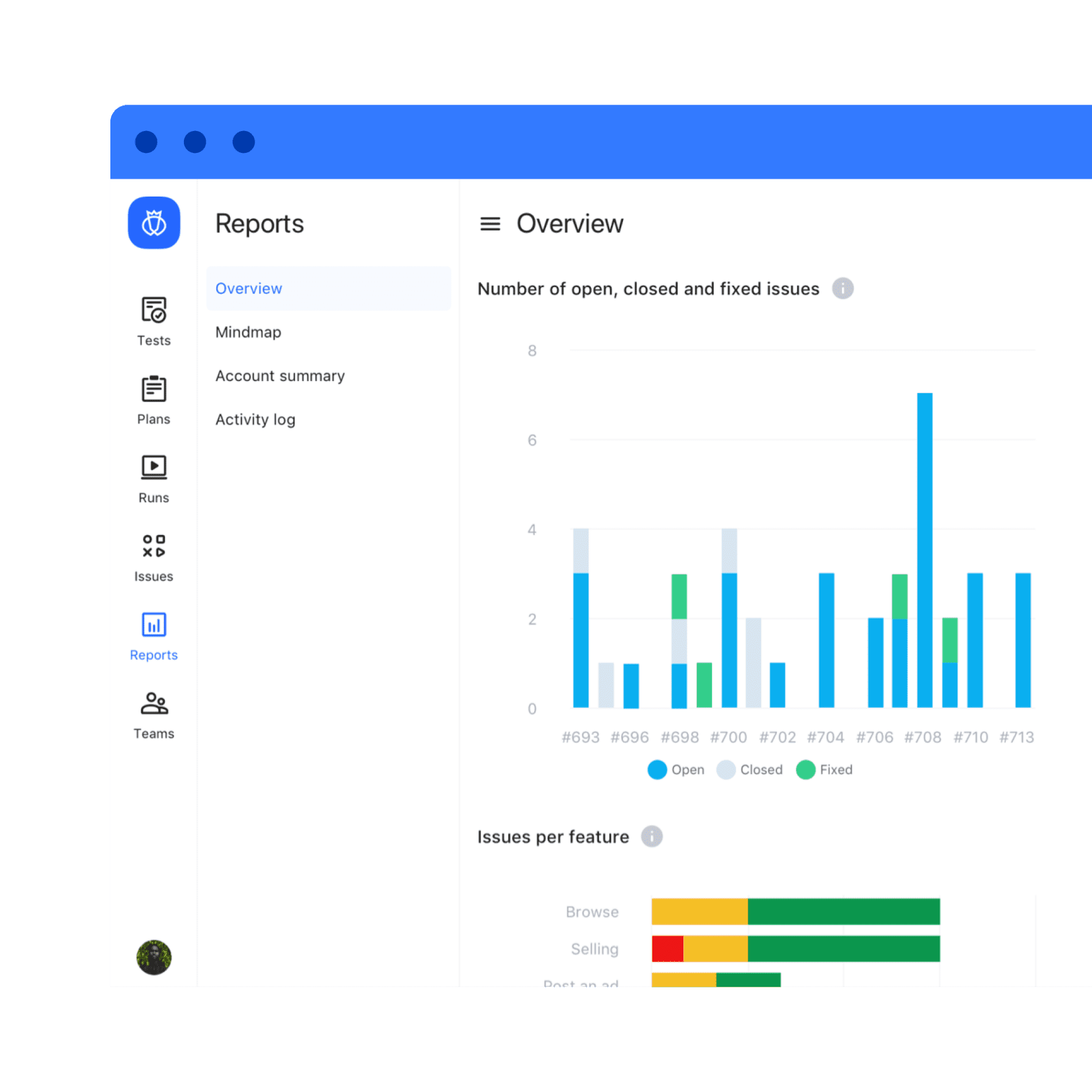

Cutting edge platform

Our platform integrates with 20+ partners, offering real-time insights into test runs, reports, and results. With a team specialized in cross-border payment testing, we ensure you confidently meet international standards.

Why prioritize cross-border payments testing

Prevent failures across markets

Waiting for customers to report issues can damage their trust in your brand. Proactively identify and address cross-border payment failures.

Launch new payment methods globally

Test and confidently introduce new payment methods across multiple markets, validating them under real-world conditions before launch.

Ensure cross-border reliability

Confirm that your payment process aligns with legal requirements, regional regulations, tax compliance, and billing standards across borders.

Expand device compatibility across regions

Validate payment device integrations, including e-wallets, smartwatches, and touchless payments, for seamless and global cross-border functionality.